CMHC’s Eco Improvement Program

CMHC’s Eco Improvement Program

CMHC’s Eco Improvement Program provides financial incentives to encourage the construction or renovation of energy-efficient homes. The Eco Program plays a pivotal role in Canada’s efforts to meet climate goals. CMHC’s Eco Program has an updated and expanded list of energy efficient certifications. Building codes are progressing toward net-zero ready standards and CMHC’s Eco Program is a Step Toward Sustainable Housing.

The initiative also promotes eco-friendly building materials, solar energy installations, and smart technology. Which help to reduce a home’s overall environmental footprint.

This means you could be eligible for a 25% refund on CMHC Insurance Premium. For some perspective; on a purchase price of $850,000 (must be below $1,500,000), with a minimum down payment of $60,000 the CMHC insurance premium is $30,600. Clients who buy a qualifying property, are eligible for a refund of up to $7900. CMHC’s Eco Program a step toward Sustainable Housing.

CMHC’s Eco Improvement Program Climate Change: A Growing Responsibility

The real estate industry is becoming increasingly aware of its environmental impact. New construction methods, energy-efficient home designs, and a greater focus on sustainability are all part of the movement to address climate change. Here are some key facts:

The Building Environment is a Major Contributor to Carbon Emissions: According to the World Green Building Council, buildings account for 39% of global carbon emissions, with energy use being the largest contributing factor.

Energy-Efficient Homes are More Attractive to Buyers: As consumers become more environmentally conscious, homes with sustainable features—such as solar panels, high-efficiency heating systems, and well-insulated walls—are growing in demand. Energy-efficient homes can sell for up to 7% more than their less-efficient counterparts, according NAR (National Association of Realtors).

Government Incentives are Growing: Programs like CMHC’s Eco Program are just one example of how governments are encouraging the real estate industry to reduce its carbon footprint. Financial incentives, rebates, and grants are available to homeowners and builders to promote energy efficiency and sustainable development.

To be Eligible:

A homeowner with CMHC Insured financing

Allocate a minimum $20,000 for energy-efficient improvements that fall within any of these 3 categories

Building Envelope (insulation, windows, doors, roof, attic, air tightness & foundation).

Mechanical systems (HVAC- Heating, Ventilation and Air Conditioning, heat pump systems).

Renewable energy systems (solar, wind, geothermal).

CMHC has made the program user friendly and beneficial for the homeowner, putting money back in their pocket is always a positive.

How do I get my Refund?:

Up to two years after the mortgage close date to submit the rebate request along with supporting documentation directly through CMHC’s website through their Eco Program and submit the application with supporting documentation. The funds can be used for any purpose, they do not have to be applied to the mortgage. The documents are good for up to five years. If the house sells the new buyer can also apply for the CMHC refund. See link to the application below.

https://www.cmhc-schl.gc.ca/en/professionals/project-funding-and-mortgage-financing/funding-programs/all-funding-programs/canada-greener-homes

Conclusion:

It’s clear that sustainability is becoming an increasingly important factor in the real estate industry. Thanks to programs like CMHC’s Eco Program, homeowners can take meaningful steps toward reducing their carbon footprint, lowering their energy costs, and contributing to the fight against climate change. The future of housing is green, and with the right incentives and awareness, the industry can lead the way in creating a more sustainable world.

Industries are looking for innovative ways to reduce their carbon footprints—and Real Estate is no exception. When it comes to homeownership, people face the choice between buying a new home or an existing one. Both options come with their own benefits. One key element shaping the future of both new and existing homes is Canada’s commitment to fighting climate change, particularly through initiatives like the CMHC’s Eco Program.

Have questions? Contact Kevin Decker, Jason Barudin, Blaire Bourcier or Tyler Moretti at Mid Island Mortgage & Savings LTD. 250-753-2242

Locally owned and operated since 1985.

“The name friends recommend”

Blog Posts

Insured Mortgage Changes

BC Tenancy and First Time Buyers

Zoning Changes: City of Nanaimo Bill 44 Response

Maximizing Income vrs Using Business Write Offs

Mortgage News

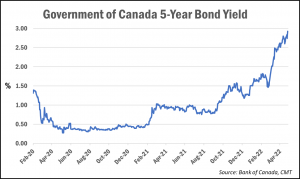

BOC Cut = lower interest costs

What Rate Cuts Mean to Borrowers

-3.jpg?width=1120&upscale=true&name=NEW%20LETTERHEADJPG%20(1)-3.jpg)

.jpg)